With no interest or fees on loans up to $1,000

American multinational tech giant Apple Inc. has officially launched its buy now, pay later plan in the United States. The latest announcement hallmarks Apple’s newest venture into the financial service industry.

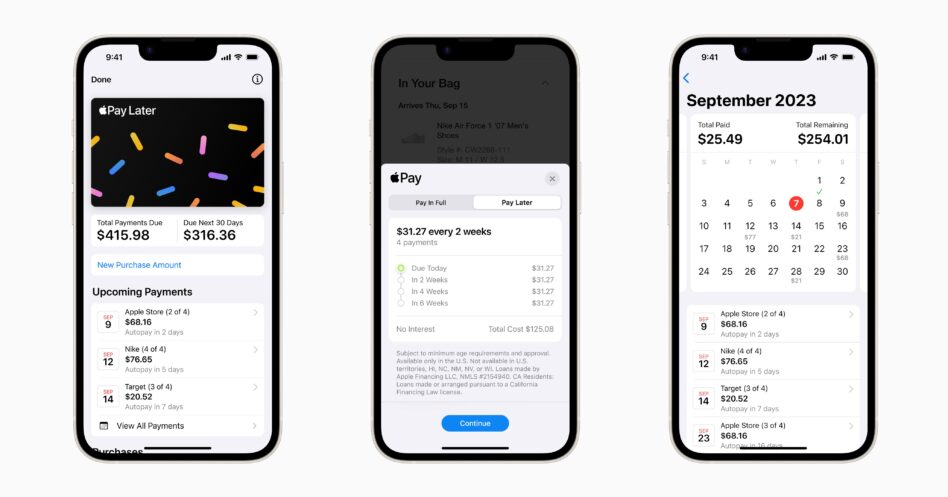

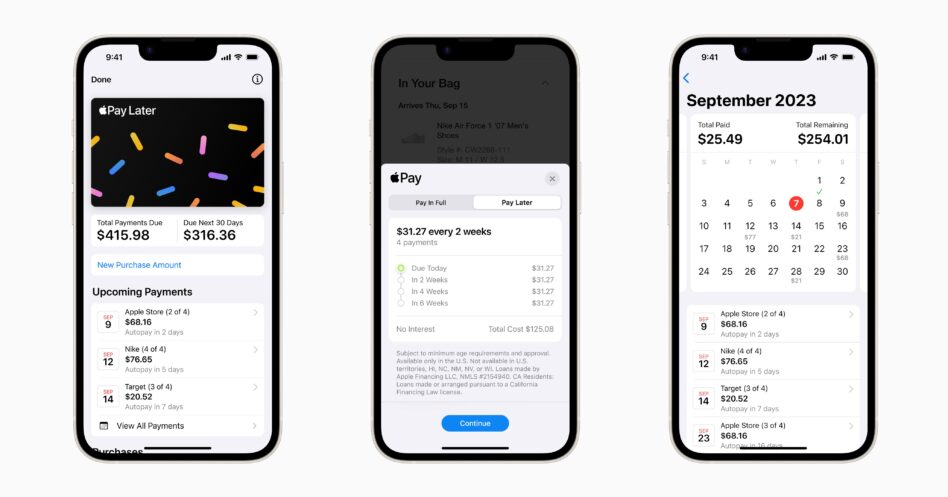

‘Apple Pay Later’ is the name of the new service and will allow customers to divide payment on their purchases into four installments payable over six weeks, with no added interest or fee. Furthermore, iPhone’s Wallet app users can now acquire credit of $50 to $1,000 using the Apple Pay Later incentive. In other words, Apple users will now be able to use Apple Pay Later to make online and in-store purchases with retailers that already accept Apple Pay. All that is required is to connect a debit card for the loan repayment process.

The new announcement is Apple’s latest attempt to use finance benefits to increase its bond with Apple customers. The new pay later program comes after the success of the launch of the Apple credit card back in 2019. The Apple credit card is praised by users for having no fees, daily cash rewards, and the ability to seamlessly sync with iPhones, making it easier than ever to keep track of finances and spending.

In June of last year, Apple first revealed it would be engineering a buy now, pay later plan that was slated to be ready by the end of the year. That time has now come as Apple will be selecting users at random this week for an early access version of Apple Pay Later.

Apple Pay Later will be the latest buy now, pay later plan to be launched in an already crowded and contested market, with many companies now offering something similar. However, Apple hopes that its flexible payment options and no late or hidden fees set them apart from competitors.

The operating of the credit assessment proceedings and financing for the program will be run by Apple’s financing unit, Apple Financing LLC. Apple Pay Later loans will begin relaying with the U.S. credit bureaus this fall and will show up on users’ credit profiles thereafter. Apple has assured users that neither purchase nor loan history will be sold or shared with any third parties and that Apple Pay Later transactions will be able to be made using Face ID, Touch ID, or a standard passcode.

Merchant stores that already accept Apple Pay won’t need to do anything to facilitate the new payment option, and Apple is now working alongside the Mastercard Inc. network to get the buy now, pay later option operational in all stores as quickly as possible.

With no interest or fees on loans up to $1,000

American multinational tech giant Apple Inc. has officially launched its buy now, pay later plan in the United States. The latest announcement hallmarks Apple’s newest venture into the financial service industry.

‘Apple Pay Later’ is the name of the new service and will allow customers to divide payment on their purchases into four installments payable over six weeks, with no added interest or fee. Furthermore, iPhone’s Wallet app users can now acquire credit of $50 to $1,000 using the Apple Pay Later incentive. In other words, Apple users will now be able to use Apple Pay Later to make online and in-store purchases with retailers that already accept Apple Pay. All that is required is to connect a debit card for the loan repayment process.

The new announcement is Apple’s latest attempt to use finance benefits to increase its bond with Apple customers. The new pay later program comes after the success of the launch of the Apple credit card back in 2019. The Apple credit card is praised by users for having no fees, daily cash rewards, and the ability to seamlessly sync with iPhones, making it easier than ever to keep track of finances and spending.

In June of last year, Apple first revealed it would be engineering a buy now, pay later plan that was slated to be ready by the end of the year. That time has now come as Apple will be selecting users at random this week for an early access version of Apple Pay Later.

Apple Pay Later will be the latest buy now, pay later plan to be launched in an already crowded and contested market, with many companies now offering something similar. However, Apple hopes that its flexible payment options and no late or hidden fees set them apart from competitors.

The operating of the credit assessment proceedings and financing for the program will be run by Apple’s financing unit, Apple Financing LLC. Apple Pay Later loans will begin relaying with the U.S. credit bureaus this fall and will show up on users’ credit profiles thereafter. Apple has assured users that neither purchase nor loan history will be sold or shared with any third parties and that Apple Pay Later transactions will be able to be made using Face ID, Touch ID, or a standard passcode.

Merchant stores that already accept Apple Pay won’t need to do anything to facilitate the new payment option, and Apple is now working alongside the Mastercard Inc. network to get the buy now, pay later option operational in all stores as quickly as possible.